The global iGaming industry faces complex financial challenges, as https://allyspin-fr.com/ demonstrates, with operators serving diverse markets with varying currencies, regulations, and payment preferences. Innovative fintech solutions are transforming international transactions, enabling seamless cross-border operations while maintaining compliance and security standards across multiple jurisdictions.

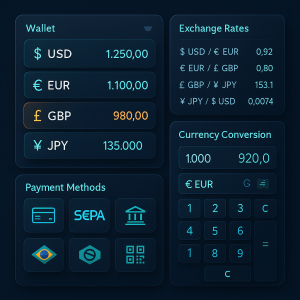

Multi-Currency Wallet Systems

Modern payment platforms integrate sophisticated multi-currency wallets that automatically handle conversions and regional preferences, eliminating the friction traditionally associated with international transactions. These advanced systems provide players with native currency experiences while operators benefit from streamlined financial operations across multiple jurisdictions.

Modern payment platforms integrate sophisticated multi-currency wallets that automatically handle conversions and regional preferences, eliminating the friction traditionally associated with international transactions. These advanced systems provide players with native currency experiences while operators benefit from streamlined financial operations across multiple jurisdictions.

Real-Time Currency Conversion

Advanced algorithmic systems ensure optimal exchange rates and transparent pricing structures through several key features:

- Dynamic exchange rates updated every 30 seconds

- Transparent fee structures showing exact conversion costs

- Smart routing algorithms selecting optimal payment paths

- Multi-currency balance displays in player’s preferred denomination

Regional Payment Methods

Different markets demand localized solutions that reflect cultural preferences and banking infrastructure maturity, requiring operators to integrate dozens of payment methods across various regions:

- Europe: SEPA transfers, Trustly, Klarna integration

- Asia-Pacific: Alipay, WeChat Pay, local banking networks

- Latin America: PIX, OXXO, Boleto Bancário support

- Africa: Mobile money solutions like M-Pesa and Orange Money

Blockchain & Cryptocurrency Integration

Digital assets are reshaping international gambling payments by eliminating traditional banking intermediaries, reducing settlement times from days to minutes, and significantly lowering transaction costs. These blockchain-based solutions offer unprecedented transparency and security while operating beyond traditional banking limitations and geographical restrictions.

Stablecoin Solutions

Cryptocurrency volatility concerns are addressed through stable digital assets pegged to major fiat currencies, providing the benefits of blockchain technology without price fluctuation risks:

- USDC and USDT for price stability during transactions

- Instant settlement without banking delays

- Lower transaction fees compared to traditional wire transfers

- 24/7 availability unrestricted by banking hours

DeFi Payment Rails

Decentralized finance protocols represent the cutting edge of financial innovation, creating autonomous payment systems that operate without central authorities while maintaining full transparency and programmability:

- Cross-chain bridges connecting different blockchain networks

- Automated liquidity provision ensuring sufficient funds

- Smart contract escrow protecting both operators and players

- Programmable compliance with built-in regulatory features

Regulatory Compliance Automation

Advanced payment systems incorporate comprehensive compliance tools that automatically adapt to local regulatory requirements across different jurisdictions, reducing manual oversight while ensuring adherence to evolving international standards. These automated systems significantly reduce compliance costs and human error while maintaining detailed audit trails for regulatory investigations.

KYC/AML Integration

Know Your Customer and Anti-Money Laundering protocols are seamlessly integrated into payment workflows, utilizing artificial intelligence and machine learning to enhance verification accuracy while reducing processing times:

- Automated identity verification using AI and biometric data

- Real-time transaction monitoring flagging suspicious activity

- Regulatory reporting automation generating required documentation

- Risk scoring algorithms assessing player and transaction profiles

Tax Withholding Management

- Automatic tax calculations based on player jurisdiction

- Withholding compliance for winnings above threshold amounts

- Detailed audit trails supporting regulatory investigations

- Cross-border tax treaty optimization minimizing double taxation

Technical Infrastructure & Security

Robust payment systems require enterprise-grade architecture:

High-Availability Systems

- 99.99% uptime guarantees with redundant server networks

- Load balancing technology handling peak traffic volumes

- Disaster recovery protocols ensuring business continuity

- Scalable cloud infrastructure adapting to growth demands

Advanced Security Measures

- End-to-end encryption protecting sensitive financial data

- Tokenization systems replacing card numbers with secure tokens

- Fraud detection AI identifying unusual transaction patterns

- Multi-factor authentication securing operator and player accounts

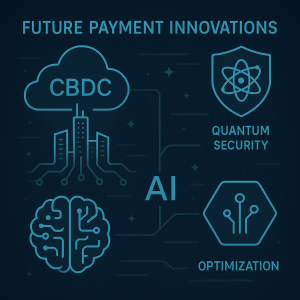

Future Innovations

Emerging technologies promise further transformation:

Central Bank Digital Currencies (CBDCs)

Government-issued digital currencies will streamline international payments while maintaining regulatory oversight.

Quantum-Resistant Security

Next-generation encryption protecting against future quantum computing threats.

AI-Powered Optimization

Machine learning algorithms continuously improving conversion rates, reducing costs, and enhancing user experience.

Cross-border payment innovation drives iGaming’s global expansion, enabling operators like Spinanga to serve international markets efficiently while maintaining the highest standards of security and compliance. These technological advances create seamless experiences that transcend geographical boundaries.